Payroll

Payroll

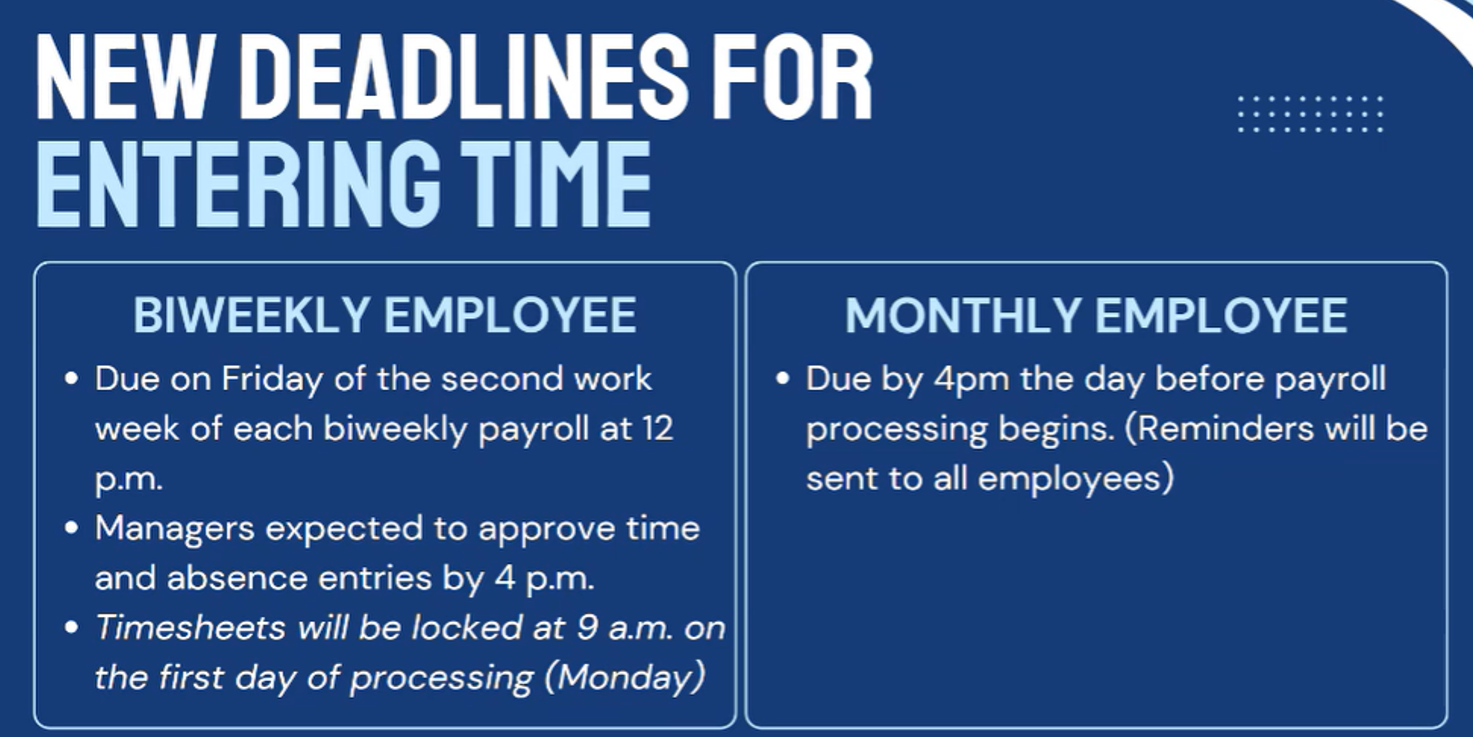

The University processes two payrolls which are the hourly bi-weekly payroll and the salaried monthly payroll. Bi-weekly paychecks are issued every other Friday after the timecard deadline. Monthly paychecks are issued on the last week day of the month.

Please contact Shared Services at support@usg.edu or (877) 251-2644.

The recordings from the Centralized Payroll Processing (CPP) training calls are now available in the links below.

- Employee Training

- Manager Training

|

2025-2026 Payroll Calendars-Timecard due dates and pay dates |

|

How to -Enter time, setup direct deposit, enter an absence request, and more |

|

Information on |

|

Tax Information |

|

USG Shared Services Help Desk

|

Payroll

- 1205 N. Patterson Street Valdosta, Georgia 31698

-

Mailing Address

1500 N. Patterson St.

Valdosta, GA 31698 - Phone: 877.251.2644

- support@usg.edu